#Income tax for 2016 and roth ira distribution full#

Once all 1099-Rs are entered, TT asks the question: " Value of 's Traditional, SEP, and SIMPLE IRAs on December 31, 2020?" The balance of my traditional IRAs are $0 as I full converted them as mentioned. I also have a traditional IRA with PRETAX money (let's say $75K for ease of example) that I fully converted to a Roth with an ending balance of $0 as of 12/31. Therefore, there is no basis, everything is kept clean, and no taxes should be owed on this amount. We contributed to 2 traditional IRAs (me and my spouse) with AFTER TAX $ and immediately converted them to our Roth IRAs via the backdoor Roth process. The existing question " Value of 's Traditional, SEP, and SIMPLE IRAs on December 31, 2020?" needs to be rewritten. Fortunately, there's a way to get around the Roth IRA income limits if you earn too much, known as a "backdoor Roth IRA.I agree completely that the FMV seems unnecessary and actually causes tax errors in some instances, like mine. If your income is too high to contribute to a Roth IRA, that doesn't necessarily mean you're out of luck.

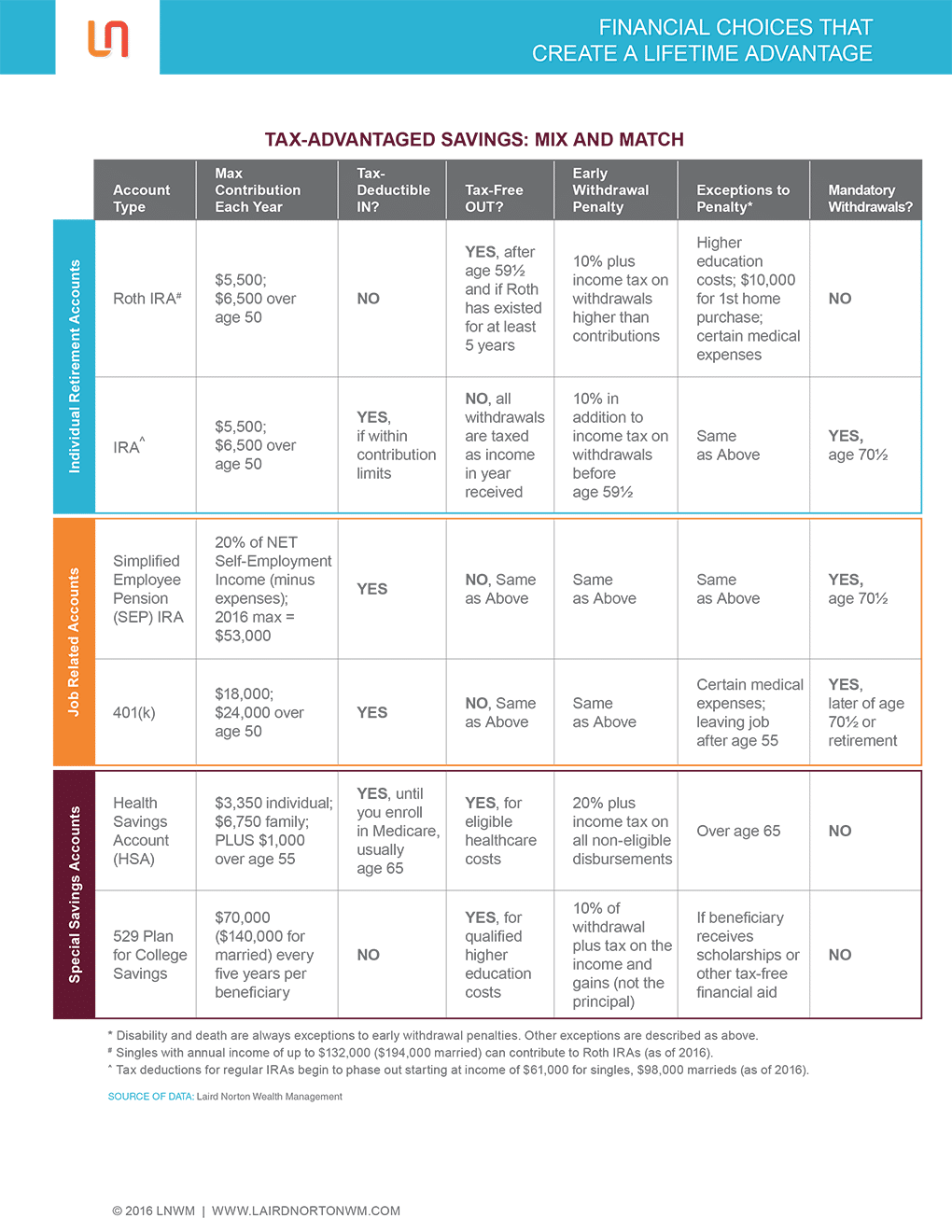

What if you make too much money to contribute? Specifically, there is no maximum age limit to contribute to a Roth IRA as long as you have earned income, and there is no required minimum distribution, no matter how old you get. Third, your total contributions to all IRAs cannot be more than the annual contribution limit ($5,500 or $6,500).Īlso, keep in mind that while the income limits may be inconvenient for some, a Roth IRA is less restrictive than other types of retirement accounts in different ways.

Second, the minimum reduced contribution amount is $200. First, reduced contribution limits are rounded up to the nearest $10, so this would actually translate to a limit of $4,040.

0 kommentar(er)

0 kommentar(er)